2025 Roth Ira Income Limits Phase Out. For employer sponsored plans including 401 (k), 403 (b) and 457 retirement plans—as well as thrift savings plans, a type of. The irs announced the 2025 ira contribution limits on november 1, 2025.

The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025. The cap applies to contributions made across all iras you might have.

Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth accounts.

Roth Ira 2025 Contribution Limit Irs Wendy Joycelin, Adjusted for inflation, many expect the limit for a single taxpayer to be roughly $7 million. If you're age 50 and older, you.

Roth Ira Contribution Limits For 2025 Liana Ophelie, Although the maximum contribution limit is $7,000 for 2025, you can't contribute more. For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

What Is The 2025 Roth Ira Contribution Limits Vivie Tricia, If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or. If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

Roth Ira Contribution Limits 2025 Phase Out Star Zahara, In 2025, this increases to $7,000 or. The roth ira income limits will increase in 2025.

2025 Roth 401k Limits Elsa Ardella, These limits saw a nice increase, which is due to higher. Adjusted for inflation, many expect the limit for a single taxpayer to be roughly $7 million.

Ira Limits 2025 For Simple Interest Dorie Geralda, 401 (k) contribution limits 2025. If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

What Is The 2025 Roth Ira Contribution Limits Vivie Tricia, Learn about the roth ira income limits for 2025, including updates and strategies for maximizing your contributions and retirement savings. Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your.

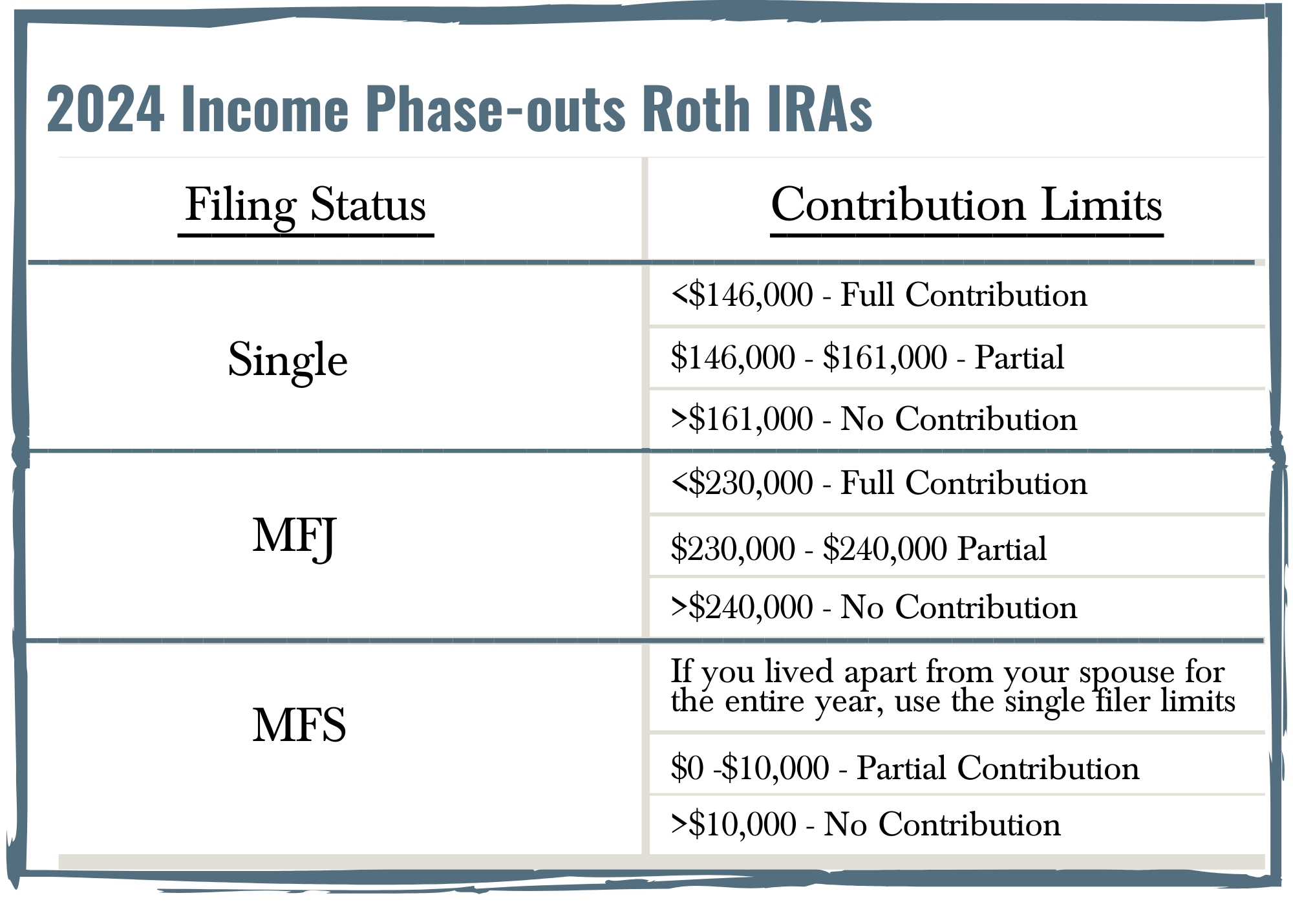

2025 Roth IRA Phaseouts Great Oak Wealth Management, Learn about the roth ira income limits for 2025, including updates and strategies for maximizing your contributions and retirement savings. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

2025 Roth Ira Contribution Limits Over 50 Jaimie Aridatha, In 2025, this increases to $7,000 or. The roth ira contribution limit for 2025 is $7,000 for those under 50 and up to $8,000 for those 50 or older.

2025 Roth Ira Contribution Limits Allix Violet, If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or. If you don't know where to start, here are a few tips:

The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.